Last Updated on August 23, 2025

Table of contents

Understanding the opportunity and the risks

So I imagine you’re wondering – “Tax Liens and Deeds – I’ve never heard of those before.” or maybe it’s “I’ve heard. ” Someone might say it won’t work because the market is small. But I want to stop those thoughts right now.

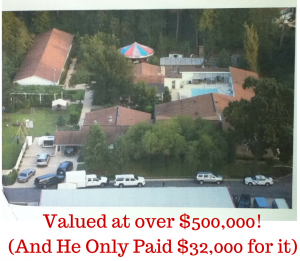

Take a look at this picture. It shows one of the properties that a student of mine bought a few months ago. He got it for an amazing price that you wouldn’t believe! Keep reading, and I’ll share how much it’s really worth and the crazy low price he paid for it.

What are tax liens and tax deeds?

When property owners don’t pay their local taxes, the cities or counties can put a tax lien on their property. This is a legal claim that says the owner owes money. To get the unpaid taxes back, the government can sell a tax lien certificate to investors. These investors pay the taxes, and later they expect to get that money back plus some interest from the homeowner.

In some areas, instead of selling tax lien certificates, the county might sell a tax deed. This means that the buyer can actually take ownership of the property if the original owner doesn’t pay off their debt. So, missing tax payments can lead to serious financial issues for property owners.

How tax lien and tax deed investing work

- Lien certificate auctions

Local governments sell certificates at auctions (online or in‑person) to recoup unpaid taxes. Investors bid either on the interest rate they will accept or the dollar amount they will pay.

- Investor’s obligations

Winning a bid does not make you the property owner; you become a creditor. You must pay the back taxes, and the homeowner must repay you within a legally specified period or face foreclosure

- Redemption or foreclosure

If the homeowner redeems the property, you earn interest set by state law. If they cannot pay, you may start a foreclosure process, which varies by state and can be complex.

- Tax deed sales

In a tax deed auction you bid to buy the property itself. There may be a redemption period allowing the owner to reclaim the property; if not, you become the owner and can sell, rent or occupy it

Returns and legal considerations

- Interest‑rate ranges – Rates vary widely by state. For example, Florida certificates yield up to 18 %, while Alabama offers a fixed 12 %. New Jersey auctions start around 8–18 %.

- Jurisdictional limits – Not every state allows tax lien certificates. Some sell only tax deeds. Always check your state or county’s regulations.

- Effort required – Successful investors perform extensive research on each property, understand local laws, and track deadlines.

- Potential profits – Returns stem from interest on redeemed liens or from selling/improving acquired properties. In some cases, investors have profited by purchasing a property for a few thousand dollars and later selling it for a much higher price. The original article’s example of buying a property for $1,000 and selling it for $11,000 reflects what can happen when due diligence pays off, but such outcomes are not guaranteed.

What are the Risks and drawbacks

- Foreclosure complexity – You may need to initiate foreclosure if the owner doesn’t redeem the lien. This process can be expensive and varies by state.

- Competition – Banks and hedge funds often bid at auctions, driving down potential returns.

- Property condition – If you end up with a property through a deed sale or foreclosure, it may be neglected or require costly repairs.

- Ethical and emotional concerns – Investing in someone else’s tax debt can feel like profiting from another person’s hardship. Some investors choose to focus on vacant lots to avoid evicting homeowners.

Case study: Turning small investments into profit

A student of mine (let’s call him “Billy”) spent roughly a year attending more than 20 auctions. After learning from one of my courses about tax lien and deed sales and conducting his own research, he purchased properties at tax sales and sold them at a profit. For example, he reportedly bought a property at a tax deed auction for $1,000 and later sold it for $11,000, and he purchased a mansion for around $32,000 that had an assessed value above $500,000. These figures show the potential upside but also underscore that success requires patience, multiple auction visits and an understanding of the market

It is possible, and I want to help you avoid some of the most common mistakes that people make, and do it with no monetary cost to you, cause I believe you can get started in this business, if you’re willing to work smart and efficiently (And have lots of fun along the way 🙂 )

Key takeaways

Let’s go through a quick recap of what we’ve talked about today:

- Government‑backed security – Tax liens are backed by local governments, making them relatively secure compared with unsecured debt.

- High potential returns – Depending on the state, lien certificates can yield interest rates from roughly 8% to 18 % or more.

- Time and effort – Investing successfully involves research, attending auctions, and understanding local laws.

- Not available everywhere – Tax lien certificates are only available in certain states; others use tax deed sales.

- Risks – Investors must be prepared for potential foreclosures, property management and ethical considerations.

Getting started

Thanks for taking the time to read this, if you have any questions about Tax Liens or Deeds, put them in the comments below, and me or one of my expert team members will get back to you as soon as possible.

Dustin HahnPS: If you want to fast track your results with Tax Liens & Deeds, check out this free “Beginners Guide To Tax Lien & Deed Investing I created. Just head on over to the page, and grab your copy today!